Europe’s Cannabis Supply Chain in Transition: Insights from Portugal, Switzerland, and Germany

Europe’s Cannabis Market Is Changing Fast

Across Europe, the cannabis industry is entering a new stage of operational and regulatory transformation. Oversight reforms, export delays, and evolving medical-market requirements are reshaping how cannabis moves across borders. While patient demand continues to grow, the region’s supply chain is constrained by bottlenecks that determine how quickly a compliant product reaches patients..

At Ziel, we monitor these shifts to help cultivators, processors, and distributors adapt to the operational realities behind policy changes. The insights below outline trends shaping Europe’s cannabis ecosystem in 2026, focusing on Portugal’s export congestion, Switzerland’s market development, and Germany’s import restrictions.

Portugal’s Logjam: When Oversight Slows Exports

Portugal remains one of Europe’s established processing hubs, with experienced operators and a mature GACP-to-GMP pathway. Exporters report that tighter verification of outbound shipments has lengthened approval timelines compared to prior years. Media coverage following enforcement actions in 2025 describes regulators focusing on license verification and documentation checks that extend timelines for operators.

Recent judicial operations, including Operation Erva Daninha in May and Operation Ortiga in July, led to arrests and seizures that pushed INFARMED to strengthen its oversight procedures. These investigations placed the agency under political pressure and triggered a wave of more thorough export reviews.

Operational Impact Reported by Exporters:

- Cash-flow strain. Slower approvals delay payments through the entire supply chain, straining cash flow for GACP cultivators around the globe utilizing the Portuguese “autobahn to Germany,” the EU-GMP processors in Portugal, and the German wholesalers and pharmacies who depend on velocity of product

INFARMED has also begun implementing a digital monitoring platform that connects with the United Nations’ National Drug Control System to track cannabis imports and exports. This new process adds data-entry and verification requirements for exporters, improving transparency but lengthening timelines.

The intent behind stricter checks is better oversight. For compliant producers, it reinforces a broader reality in Europe’s market: administrative speed is now a competitive advantage. Despite the delays, data shared by INFARMED at the 2025 Portugal Medical Cannabis Conference showed that Portugal exported more cannabis by August 2025 than during all of 2024. That momentum came to a screeching halt with delayed export licenses in tandem with Germany halting import licenses due to its exceeding its UN Narcotics quota in September.

The Shift Toward Self-Processing

To reduce reliance on third-party ‘GMP washers’ and to protect margins, many GACP cultivators are pursuing their own EU-GMP Level 1 processing licenses. Properly authorized facilities perform microbial reduction, trimming, and packaging under documented GMP standards that meet pharmaceutical expectations.

Ziel supports this transition by supplying radio-frequency systems, process validation tools, and technical expertise that help cultivators achieve full EU-GMP compliance on-site. Managing post-harvest steps internally can streamline processing, shorten export timelines,tighter quality control, improved margins, and quicker speed to market with fresher products. This shift is also visible in countries such as Colombia, Thailand, and smaller EU states, where producers are building vertically integrated GMP operations to control every stage from cultivation through processing.

Switzerland: A Balanced, Rules-Driven Market

Switzerland’s 1% THC threshold for non-medical products created a strong CBD-flower base that now supports medical production. Since August 2022, cannabis for medical use has been governed by Swissmedic under the controlled-substances regime, with prescriptions permitted and exports allowed through authorization.

Industry participants at recent European conferences note that years of CBD cultivation under GACP produced skilled teams and repeatable post-harvest systems, which can ease the path to EU-GMP for medical supply. Capacity for EU-GMP flower processing remains limited.

With a clear medical rule set and seasoned operators, Switzerland functions as a bridge between non-EU cultivators and European buyers.

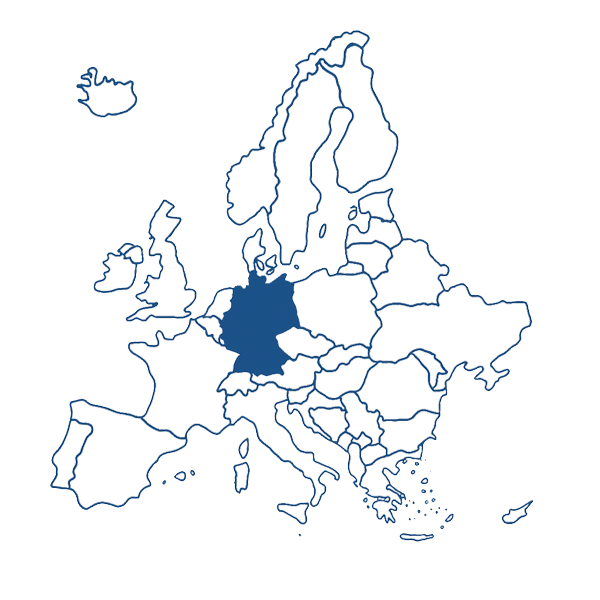

Germany: The Quota That Slowed the Continent

Germany remains Europe’s largest medical market and a clear example of policy setting the pace of trade. Trade publications, citing statements attributed to the Federal Institute for Drugs and Medical Devices (BfArM), reported in September 2025 that no new permits for imports of dried cannabis would be granted for the remainder of the year, referencing an annual quantity of 122 tons. While this was not a formal import ban, it halted granting new import licenses until the quota was raised in late October to 192.5 tons for calendar 2025. The market essentially froze up for 2 months while tons of product sat outside Germany’s borders. timelines for pending shipments.

Reported Effects Include:

- Wholesaler shortages that complicate pharmacy fulfillment.

- Extended storage and stability work for exporters holding inventory longer than planned.

- Price pressure as well-stocked producers compete for limited permit windows.

- Price erosion for exporters. Cannabis is perishable, and cannabis aging in a warehouse depreciates in value every day it sits out of the market.

The takeaway is clear: demand exists, but throughput depends on permit allocation and processing speed.

A Common Theme: Compliance Bottlenecks Over Cultivation Gaps

Across Europe, the problem is less about growing capacity and more about process. Oversight delays, certification limits, and import caps slow movement across producing countries.

- Portugal faces export-verification backlogs.

- Switzerland has limited EU-GMP flower processing capacity relative to demand.

- German demand is outpacing annual import quotas set by the UN Narcotics Treaty (which cannabis still falls under) leading to distribution interruptions until quotas can be reset, is subject to annually negotiated UN Narcotics caps

Ziel’s technology supports this needed agility, helping producers integratepost-harvest decontamination solutions on-site that maintain microbial safety, preserve quality, and accelerate product to market.

What Comes Next: Data-Driven Progress

Sustainable growth now depends on efficiency. As more cultivators move to self-processing and EU-GMP certification, Ziel will continue to help teams meet compliance requirements and achieve predictable throughput across borders.

By combining EU-GMP validated Radio Frequency technology with data-backed process controls, Ziel enables businesses to move compliant cannabis safely, predictably, and profitably throughout the European medical supply chain.

References

- StratCann – “Germany: No new import permits for dried cannabis in 2025.”

- MMJ Daily – “Germany: No new import permits for medical cannabis for now.”

- ManoxBlog – “Germany cannabis import permits suspended; maximum quantity of 122 tonnes reached.”

- Swissmedic – “Medical cannabis regulation and export authorization guidance.”

- Swiss Government (Federal Office of Public Health) – “CBD products and the 1% THC limit.”

- Business of Cannabis – “Portuguese enforcement actions highlight licensing and export compliance issues.”